Pay Versus Performance – SEC Adopts Final Rule

Pay Versus Performance: RDG makes it simple.

The SEC is bringing together RDG’s core competencies of TSR and Inline XBRL Tagging to the Annual Proxy Statements preceding shareholder meetings.

Overview:

The SEC finalized a new rule addressing Pay Versus Performance on August 25, 2022. The new rule requires companies to disclose information reflecting the relationship between executive compensation and financial performance. The rule brings together existing requirements while incorporating the SEC’s focus on modernization by mandating Inline XBRL (iXBRL) tagging of executive compensation data and comparing it with Total Shareholder Return (TSR) within one table in the proxy statement.

The SEC initially proposed the Pay vs Performance rule in 2015 and reopened the proposal for comment in 2022. The final rule becomes effective for fiscal year ends on or after December 16, 2022.

Requirements:

The rules will apply to all reporting companies, except foreign private issuers, registered investment companies, and Emerging Growth Companies. Smaller Reporting Companies (“SRCs”) will be permitted to provide scaled disclosures.

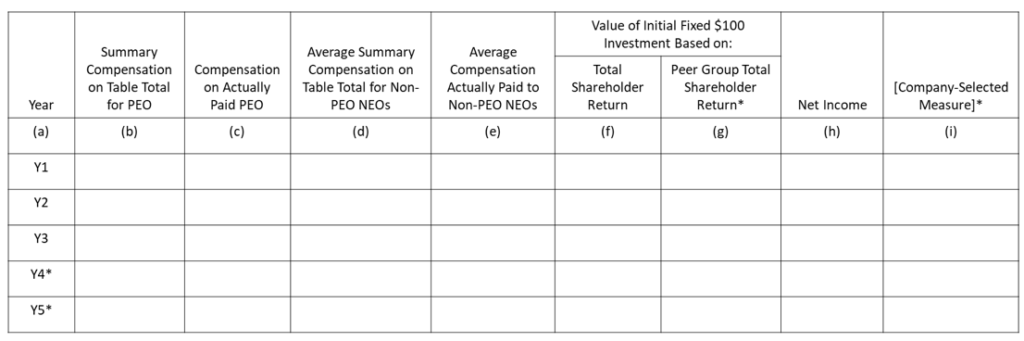

New Item 402(v) of Regulation S-K will require registrants to provide a table disclosing specified executive compensation and financial performance measures for the registrant’s five most recently completed fiscal years.

Registrants will be required to include in the table, for the principal executive officer (“PEO”) and, as an average, for the other named executive officers (“NEOs”), the Summary Compensation Table measure of total compensation and a measure reflecting “executive compensation actually paid,” calculated as prescribed by the rule.

The financial performance measures to be included in the table are:

- Total shareholder return (“TSR”) for the registrant;

- TSR for the registrant’s peer group;

- The registrant’s net income; and

- A financial performance measure chosen by the registrant and specific to the registrant (the “Company-Selected Measure”) that, in the registrant’s assessment, represents the most important financial performance measure the registrant uses to link compensation actually paid to the registrant’s NEOs to company performance for the most recently completed fiscal year.

Item 402(v) also will require a registrant to provide a clear description of the relationships between each of the financial performance measures included in the table and the executive compensation actually paid to its PEO and, on average, to its other NEOs over the registrant’s five most recently completed fiscal years.

The registrant will be required to also include a description of the relationship between the registrant’s TSR and its peer group TSR.

A registrant will also be required to provide a list of three to seven financial performance measures that the registrant determines are its most important measures (using the same approach as taken for the Company-Selected Measure). Registrants are permitted, but not required, to include non-financial measures in the list if they considered such measures to be among their three to seven “most important” measures.

Registrants will be required to use Inline XBRL to tag their pay versus performance disclosure.

Implementation Dates: Registrants are required to comply with proxy statements for fiscal years ending on or after December 16, 2022.

- Large accelerated and accelerated filers will be required:

- to provide three years of data in the first proxy or information statement which contains the disclosure,

- adding another year of data in each of the two subsequent annual proxy filings that require the disclosure (for a total of five years).

- Smaller Reporting Companies (SRC) will:

- Initially be required to provide two years of data,

- adding an additional year of disclosure in the subsequent annual proxy or information statement that requires the disclosure.

- Additionally, SRCs will only be required to report the data in Inline XBRL beginning in the third filing which contains pay versus performance disclosure, instead of the first.

Note: The rules do not apply to Foreign Private Issuers, Investment Management filers (such as Business Development Companies) or Emerging Growth Companies.

Resources: